China’s Video Surveillance Boom: How AI, Cloud, and Smart Cities Are Shaping a $10 Billion Market

Publish:

2025-10-13 11:04

Source:

https://www.ring-see.com

Introduction: The World’s Largest Security Ecosystem in Motion

Few countries have transformed public safety and urban monitoring as rapidly as China. Once known for mass camera deployment alone, the country’s surveillance industry is now entering a new stage — one driven by artificial intelligence (AI), cloud computing, and smart-city integration.

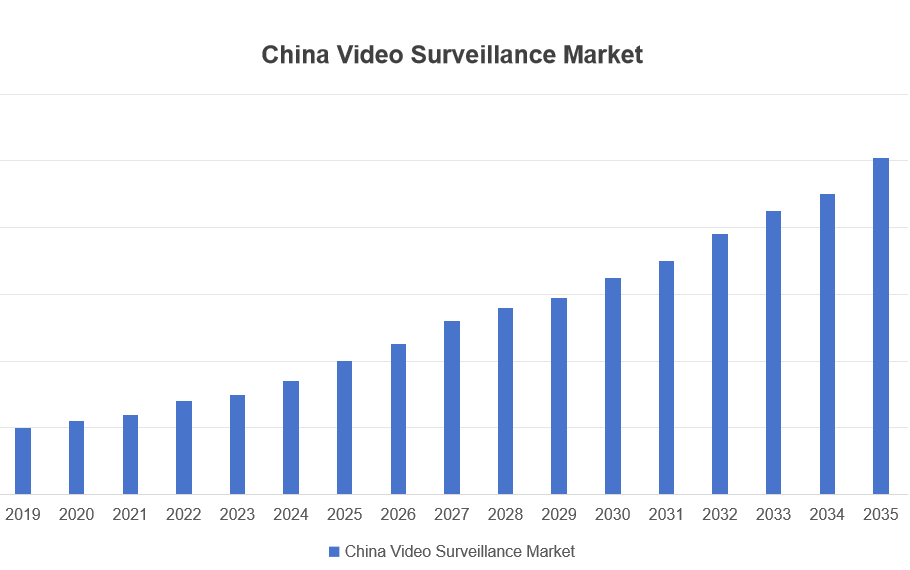

According to industry estimates, China’s video surveillance market will expand from around USD 3.38 billion in 2024 to over USD 10.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of about 10.5%. Behind this growth lies a clear strategy: transforming raw video feeds into intelligent systems that serve both government and commercial needs.

The Evolution of Surveillance: From Hardware to Intelligence

From cameras to cognition

A decade ago, surveillance in China was largely about camera density — “the more, the safer.” Today, that logic has evolved. Governments and private users now demand not just visibility, but real-time interpretation.

Modern systems can detect abnormal behaviors, analyze traffic flows, recognize faces or license plates, and even predict potential risks. This shift from passive monitoring to active intelligence is reshaping the entire market.

Hardware still leads — but software is the new growth engine

Hardware remains the foundation of China’s video surveillance ecosystem. In 2024, the hardware segment is valued at about USD 1.04 billion, primarily consisting of cameras, network devices, and storage units. But the real acceleration lies in software and services — together projected to account for more than half of total market revenue by 2035.

Software platforms enable analytics, AI recognition, and smart data management, while services — such as cloud storage and system maintenance — bring recurring revenue. This transition signals a broader market maturity where the value is shifting from products to platforms.

Key Drivers Powering Market Growth

1. Smart City Development

China’s “smart city” initiatives have been central to its national modernization agenda. Surveillance networks form the digital backbone of these cities — linking traffic systems, emergency response, and infrastructure management under one analytical framework.

With over 1,000 smart city projects across the country, demand for integrated video systems has surged. Municipal governments are adopting cloud-based command centers capable of managing millions of data points — from video streams to sensor readings — in real time.

2. AI and Machine Learning

Artificial intelligence is no longer experimental; it’s now core infrastructure. Facial recognition, license plate identification, motion analysis, and pattern tracking are routinely embedded into both government and enterprise systems.

This AI integration is enabling a more proactive approach to security — not only detecting but predicting incidents such as suspicious gatherings, illegal parking, or perimeter breaches. As algorithmic accuracy improves, the adoption of AI-driven analytics is expanding rapidly in urban, retail, and industrial applications.

3. Cloud Computing and IoT Convergence

The shift to cloud-based architectures is another defining trend. Traditional DVR/NVR systems are being replaced with scalable, remote-accessible platforms that store and process data in the cloud.

At the same time, integration with Internet of Things (IoT) devices — sensors, access control, environmental monitors — allows for comprehensive data fusion. This convergence creates a network of “smart eyes and ears,” capable of holistic situational awareness.

4. Rising Private and Commercial Demand

While government procurement remains dominant, private sector applications are growing quickly. Retail chains, logistics hubs, healthcare facilities, and educational institutions increasingly depend on intelligent surveillance to enhance operational safety and customer experience.

Even residential communities and property developers are turning to AI-enabled home and neighborhood security, reinforcing the domestic demand base.

Market Breakdown: Segments and Opportunities

Hardware Segment

Hardware, including cameras, recorders, and network infrastructure, continues to account for the majority of installations. However, competition among local manufacturers such as Hikvision, Dahua, and Uniview is driving prices down and accelerating innovation in low-power, solar, and wireless designs.

Edge AI chips and 4G/5G connectivity are further enhancing the hardware’s independence and responsiveness.

Software Segment

The software market is expected to reach USD 3.3 billion by 2035, making it the fastest-growing category. Key software functions include:

- Intelligent video analytics

- Centralized management systems

- Cloud storage and big data integration

- Cybersecurity and data protection modules

Software vendors that can provide modular, scalable, and open-architecture solutions will dominate future growth.

Service Segment

Professional services — system integration, maintenance, data analysis, and managed security — are forecasted to hit USD 2.75 billion by 2035. This reflects a shift in buyer preferences: end-users no longer just want cameras; they want turnkey solutions that guarantee uptime, compliance, and insight.

The service-driven model also encourages subscription-based pricing, bringing stability to vendors and flexibility to customers.

Competitive Landscape: The Battle for Ecosystems

Local dominance, global presence

Chinese brands remain at the forefront of global video surveillance exports. Giants such as Hikvision, Dahua, and Uniview have built massive ecosystems around AI-driven hardware and management platforms.

Meanwhile, international players like Axis Communications and Bosch Security Systems continue to serve the high-end enterprise segment, emphasizing data protection and compliance.

Ecosystem competition

The new battlefield is not hardware specifications but ecosystem integration — how well companies can combine devices, software, and services into one interoperable system.

Vendors are investing heavily in R&D to enhance AI analytics, edge computing, and cybersecurity features. Partnerships with telecom operators, cloud providers, and smart-city integrators are also expanding, aligning surveillance technology with broader digital infrastructure goals.

Technology Trends to Watch

Edge AI Processing

By embedding AI directly into cameras and recorders, edge computing reduces latency and bandwidth consumption. This is especially crucial in rural or remote deployments where cloud connectivity may be limited.

Low-Power and Solar Surveillance

As sustainability becomes a global priority, solar-powered and battery-backed cameras are gaining traction — particularly in outdoor and off-grid environments. Chinese manufacturers are leading this trend, producing high-efficiency, low-power surveillance units that support AI analytics without constant grid power.

4G/5G Connectivity

The rollout of 5G networks enables faster transmission and higher-resolution streaming. This supports real-time analytics for critical applications such as autonomous transportation and emergency response.

Cybersecurity Reinforcement

With data volumes surging, video data protection is a top concern. Vendors are enhancing encryption, user authentication, and compliance frameworks to align with evolving data privacy laws both in China and internationally.

Regulatory Environment and Data Governance

China’s data governance framework has matured significantly over the past few years. Regulations now emphasize data localization, user privacy protection, and responsible AI deployment.

Manufacturers and service providers must ensure that their solutions adhere to these regulations — not only to maintain compliance but to gain trust among global buyers wary of data security risks.

The industry’s success will increasingly depend on transparency, accountability, and ethical innovation — qualities that influence both domestic acceptance and international competitiveness.

Challenges and Risks Ahead

While the outlook remains strong, several challenges could shape the pace of growth:

Market Saturation in Urban Areas – As major cities reach near-full coverage, incremental growth will depend on system upgrades rather than new installations.

Price Pressure – Intense competition among domestic vendors continues to push prices down, squeezing margins in the hardware segment.

Data Privacy Concerns – Increasing public and international scrutiny of surveillance technologies requires stronger data protection frameworks.

Geopolitical Factors – Export restrictions and trade policies may affect international market access for Chinese manufacturers.

Addressing these challenges will require continued innovation, strategic differentiation, and robust compliance strategies.

The Future: From Surveillance to Situational Intelligence

By 2035, China’s video surveillance network will no longer be seen merely as an “eye” — it will act as a brain for urban management, industrial safety, and national infrastructure.

AI algorithms will not only detect incidents but anticipate them. Cameras will communicate with vehicles, buildings, and IoT devices in real time. Cloud systems will automatically adjust city lighting, traffic flow, or emergency response based on visual data insights.

This vision is what truly defines the next era of China’s surveillance ecosystem — a shift from observation to autonomous decision-making.

Conclusion: The Opportunity Beyond the Lens

China’s video surveillance industry embodies the intersection of security, technology, and innovation. With a projected market value exceeding USD 10 billion by 2035, it represents not just economic expansion but a paradigm shift toward integrated, intelligent infrastructure.

Manufacturers, software developers, and system integrators that align with this transformation — focusing on AI, cloud connectivity, sustainability, and compliance — will define the next decade of global security technology.

As the line between “camera” and “computer” continues to blur, China’s model of intelligent surveillance may serve as both a blueprint and a challenge for the world — to make security smarter, faster, and more connected than ever before.

Prev:

Related News

China’s Video Surveillance Boom: How AI, Cloud, and Smart Cities Are Shaping a $10 Billion Market

Explore China’s booming video surveillance market — driven by AI, cloud, and smart cities — projected to exceed USD 10B by 2035. Learn key trends & insights.

Oct 13,2025

Can Wildlife Cameras Recognize Specific Animals? The Rise of AI-Powered Detection in Conservation

Discover how AI-powered wildlife cameras are transforming animal recognition and species monitoring. Learn how intelligent camera systems—like those developed by Ringsee—can identify, classify, and even track individual animals to support global conservation efforts.

Oct 11,2025

How China’s Security Camera Market Is Evolving: Scale, Players, and Strategic Trends

In-depth analysis of China’s security camera market in 2025: market size, leading vendors, edge-AI and connectivity trends, OEM opportunities, and regulatory/export risks that shape global supply chains.

Oct 11,2025

How a 4G Solar Camera Protects Your Vacation Home Year-Round

Discover how 4G solar cameras keep your vacation home secure all year, even in remote areas without WiFi or power. Learn how Ringsee, a trusted Chinese manufacturer, offers reliable solar-powered security solutions for holiday homes.

Oct 10,2025

How Solar-Powered Wildlife Cameras Are Changing Conservation: What to Know & What to Buy

Explore how solar-powered wildlife cameras are transforming conservation and biodiversity research. Learn key buying tips, essential features, and discover trusted manufacturers like Ringsee—China’s expert in low-power solar wildlife monitoring systems.

Oct 10,2025