How Smart Surveillance Cameras Are Transforming the Pet Industry — Market Status, Marketing Playbook, and Future Trends

Publish:

2025-10-22 11:58

Source:

https://www.ring-see.com

Smart pet cameras have moved beyond a niche gadget into a mainstream pet-tech category. Rising pet ownership, stronger humanization of pets, and rapid improvements in low-cost camera hardware and on-device AI are pushing demand for connected, interactive, and intelligence-rich devices used by pet parents, shelters, pet hotels, and pet-care professionals. Manufacturers and sellers who focus on clear product differentiation (health & behavior insights, two-way interaction, treat-dispensing, privacy-first cloud plans) and B2B channels (veterinary clinics, pet-care chains) will win share as the category shifts from “watching” to “caring” and “insight.” Arizton Advisory & Intelligence

Market snapshot

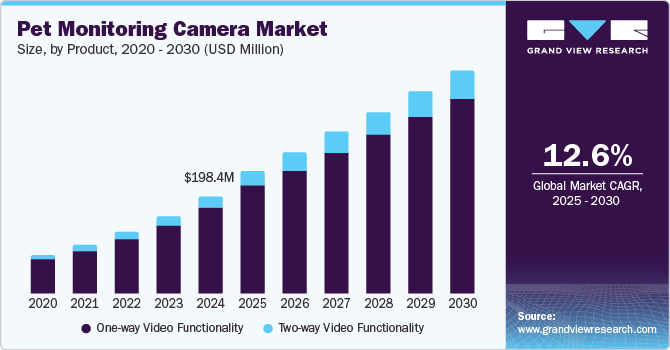

The broader pet-tech market is expanding rapidly: analysts estimate the global pet-tech market was worth several billion USD in 2024 and is forecast to grow strongly during the 2025–2030 period. Arizton Advisory & Intelligence

Smart pet camera-specific market estimates vary by source, but recent industry reports place the smart pet camera market around the low billions in 2024 with double-digit CAGR forecasts into the mid-2020s (example: a 14%–16% CAGR reported by market analysts). These projections reflect steady hardware sales plus recurring cloud/subscription revenue. The Business Research Company

Regional demand is strongest in North America (high pet ownership and willingness to spend), with Asia-Pacific showing fast growth as urbanization and disposable income rise.

Why pet owners — and pet businesses — buy smart cameras

Emotional drivers

Humanization of pets: owners treat pets like family members and invest in products that increase welfare and reduce separation anxiety.

Practical drivers

Safety and monitoring (e.g., detecting destructive behavior or emergencies), remote interaction (two-way audio, pet-friendly sounds), and automated care actions (treat dispensers or feeding integration).

Commercial drivers

Pet hotels, daycare centers, shelters, and vets buy camera systems for liability management, operational monitoring, and to offer live-streaming as an upsell to pet parents.

Key features shaping product marketing

On-device AI & behavior detection: automatic recognition of barking, pacing, or falling asleep patterns; also person vs. pet detection to cut false alerts.

Two-way interaction + pet-friendly sounds: not all owners like full conversation via camera; tailored audio and short sounds can be more effective.

Treat dispensing & automated interaction: a proven differentiator for pet-focused cameras — a clear emotional & feature-led selling point.

Privacy & data policies: subscriptions and cloud video storage raise privacy questions — transparent data handling and local-storage options are marketing advantages.

Integration with broader pet health tech: APIs or partnerships with smart feeders, collar telemetry, or vet-telehealth make a product more “sticky.”

A tactical marketing playbook for manufacturers & sellers

Positioning & messaging

From “watch” to “care”: frame the camera as an active care tool — not just surveillance — highlighting behavior alerts, health signals, and interaction features.

Persona-driven content: create distinct messaging for (a) urban millennial pet parents, (b) busy professionals, and (c) pet businesses (daycare/vets). Use short video demos for each persona.

Trust-first messaging: emphasize privacy, data ownership, encryption, and local storage options.

Channels & growth tactics

Content & education marketing: blog posts, how-to videos (e.g., “How to stop separation anxiety with remote enrichment”), and downloadable checklists for pet-sitters and kennels.

Partnerships: co-marketing with vets, pet insurers, and pet-sitting platforms; offer B2B bundles for boarding facilities.

Retail & marketplace optimization: optimize listings with clear benefit-led bullet points (treat-dispense, behavior alerts, battery/backup options) and real-use videos.

Subscription upsells: free basic app + paid cloud/analytics tiers; highlight case studies where analytics prevented problems.

Influencer & micro-influencer campaigns: real pet owners showing genuine outcomes (reduced destructive behavior, calmer pets) outperforms staged ads.

Pricing & packaging

Tier hardware: entry-level HD camera (monitoring), mid-tier (two-way + treat), premium (AI behavior analytics + integrations).

Offer B2B pricing for multi-camera deployments and a white-labeling/OEM option for pet-care chains.

Product roadmap & R&D priorities that support marketing claims

Improve on-device intelligence so alerts are meaningful (behavioral context rather than noisy motion triggers).

Battery life & offline modes for customers who want local fallback.

Interoperability & APIs to join the pet-care ecosystem (collars, feeders, health apps).

Ethical AI & privacy-by-design to reduce regulatory and consumer trust risk.

Future trends — what to bet on

Behavioral analytics and predictive alerts: analytics that move from reactive alerts to predictive care (e.g., early signs of anxiety or illness) will create high perceived value and recurring revenue.

Tighter integration with wearables and vet telehealth: camera + collar data fused to provide richer health insights and remote triage.

Edge AI for privacy and latency: on-device inference reduces cloud dependency, lowers cost, and eases privacy concerns.

Subscription-based care platforms: cameras as gateways to paid services (training courses, vet consultations, personalized enrichment plans).

Commoditization of basic features, differentiation via insights: as HD video and two-way audio become table stakes, differentiation will shift to insights, integrations, and trustworthy service.

Risks and challenges

- Overpromising on “translation” or behaviour diagnosis: owners want translation tech, but robust scientific backing is limited — market cautiously.

- Privacy & regulation: stronger data protection laws and consumer pressure mean transparent policies are non-negotiable.

- Price sensitivity for commoditized hardware: competing on features + services (not just price) reduces margin erosion.

Smart pet cameras are evolving from “live view” gadgets to integrated care platforms. The companies that succeed will be those that combine reliable hardware, trusted privacy practices, and AI-driven insights that genuinely improve pet welfare — and then market those benefits in persona-focused, partnership-driven channels. With the market growing healthily, now is the time to position hardware as an entry point into a longer-term pet-care relationship.

Prev:

Related News

Discover the 2025 market outlook for smart pet cameras, marketing strategies that convert, and future trends—AI behavior alerts, integrations, and subscription opportunities.

Oct 22,2025

Consumer vs. Enterprise Priorities in AI Security Cameras

Explore the key differences between consumer and enterprise priorities in AI security cameras. Learn how manufacturers like Ringsee from China deliver privacy, scalability, and compliance to meet both markets’ needs.

Oct 21,2025

Do Trail Cameras Affect Wild Animals’ Behavior? Understanding Their Real Impact

Do trail cameras affect wildlife behavior? Learn how animals react to cameras and discover how no-glow solar trail cameras from Ringsee minimize disturbance for ethical, accurate observation.

Oct 16,2025

How to Find Top Mini Camera Manufacturers in China: 5 Leading Suppliers & Buyer’s Guide

A detailed guide to locating and vetting mini camera manufacturers in China. Discover 5 leading Chinese suppliers, tips for sourcing, and strategies to validate quality and reliability.

Oct 15,2025

How Solar Trail Cameras Quietly Win You More Time in the Field

swap frequent battery-swap trips for a solar-powered trail-camera setup and you’ll disturb game less, lose fewer key photo windows to dead batteries, and free up hours (and dollars) to invest back into better scouting and more time hunting. The case for solar isn't just technical — it’s tactical.

Oct 14,2025

Links:One Belt Power Technology

Add: 14th Floor, Baoshan Building, Longhua District, Shenzhen China.

Privacy Policy | SEO | CitySite | Support: 300.cn Dongguan

COOKIES

Our website uses cookies and similar technologies to personalize the advertising shown to you and to help you get the best experience on our website. For more information, see our Privacy & Cookie Policy

COOKIES

Our website uses cookies and similar technologies to personalize the advertising shown to you and to help you get the best experience on our website. For more information, see our Privacy & Cookie Policy

These cookies are necessary for basic functions such as payment. Standard cookies cannot be turned off and do not store any of your information.

These cookies collect information, such as how many people are using our site or which pages are popular, to help us improve the customer experience. Turning these cookies off will mean we can't collect information to improve your experience.

These cookies enable the website to provide enhanced functionality and personalization. They may be set by us or by third-party providers whose services we have added to our pages. If you do not allow these cookies, some or all of these services may not function properly.

These cookies help us understand what you are interested in so that we can show you relevant advertising on other websites. Turning these cookies off will mean we are unable to show you any personalized advertising.